OBDX helps Banks enhance Digital Customer journeys, deliver seamless experiences and embrace Open Banking

What is OBDX (Oracle Banking Digital Experience)?

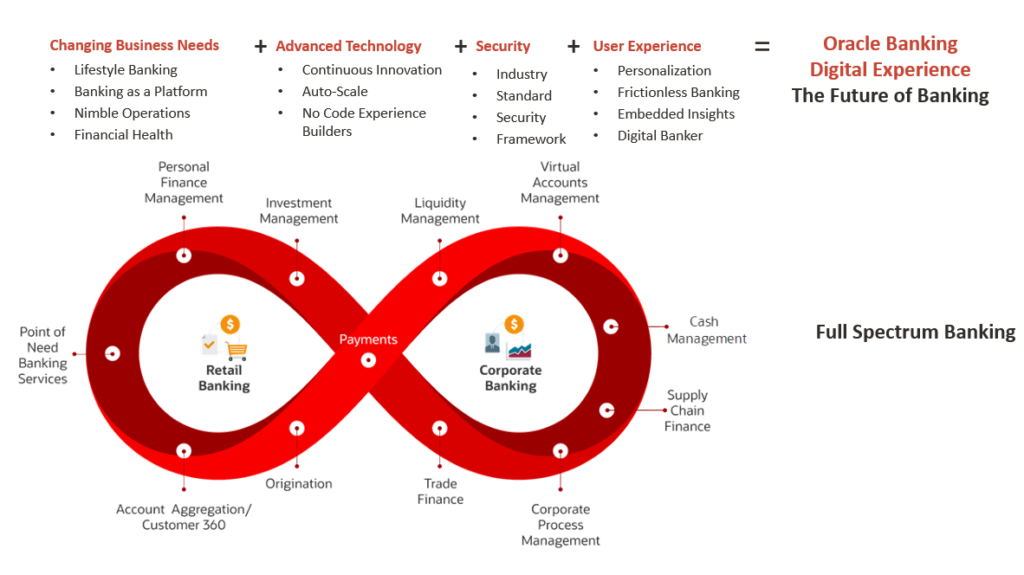

Oracle Banking Digital Experience is a digital banking platform that enables banks to progressively transform into a digital banking powerhouse. The solution is designed to completely service a customer’s financial needs at any point in their lifecycle through a digital channel of their choosing. Banks can offer their retail and corporate customers AI and ML-powered highly intuitive, context-aware solutions which simplify their daily routine.

Oracle Banking Digital Experience (OBDX) brings enterprise-class, open, cloud-ready, scalable, digital banking solutions.

Elevate Digital Banking Experiences with with OBDX

- A robust Digital platform delivering true Omni-Channel experience to Customer across all Channels

- A comprehensive digital banking suite that encompasses Retail, SME, Corporate, and Islamic business lines

- Open Banking ready and highly extensible solution capable of integrating into bank’s internal landscape. Additionally, it can extend to support Bank’s ecosystem partners via Banking API increasing monetization

- Retail Digital Banking capabilities affords seamless banking experience via Personalized and contextual dashboards, Smart Navigation and Conversational Banking support. It brings Full Spectrum Retail Banking servicing capabilities enabling customer to originate and transact digitally.

- Corporate Digital Banking capabilities supports SME, Mid-market and Large Corporate customer needs. It encompasses Cash Management, Liquidity Management, Virtual Accounts, Trade Finance, Supply Chain Finance, Corporate Lending and Credit facilities

JMR Infotech has implemented OBDX (Oracle Banking Digital Experience) for Digital Only Banks, Islamic Banks, Challenger Banks apart from Omni-Channel implementations across Digital, Branch and other channels. Our clients have experienced 350-500% growth in Digital transactions volumes post-implementation of OBDX solution components.

![]() Our Success Stories – Case Studies

Our Success Stories – Case Studies

No post found

![]() Related Resources

Related Resources

COVID 19: Time to unleash the full power of digital technologies in Financial Services

A Quantum Leap in Banking Technology

Key Takeaways from Deutsche Bank Research: Imagine 2030- Cryptocurrencies: The 21st century Cash

Our Experts